27+ Borrowing capacity mortgage

View all Mortgage Brokers. 4 Securities Exchange Act Rule 15c3-1 17 CFR.

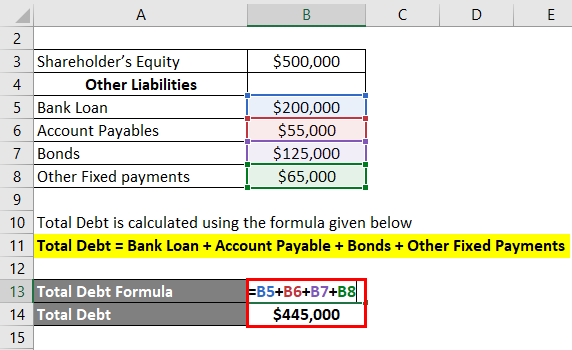

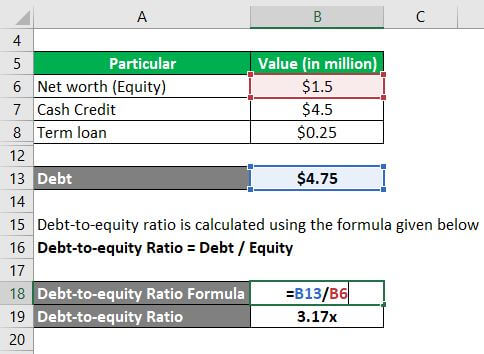

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

An important aspect of business borrowing is the form of security required - property or business assets.

. As intermediaries between purchasers and lenders mortgage brokers suggest loan solutions to address need. Learn how to pick a mortgage based on your needs. 589 Percent Weekly Ending Thursday Updated.

The 5 Cs of credit are character capacity collateral capital and conditions. Their skills lie in securing competitive loans for clients. Calculate how much I can save ME N Item - 4 Col c Stamp duty.

Anytime you have a body in a barrel clearly there was somebody else involved Ukraine Cold Turkey. 2 days agoSome prospective home buyers with finance pre-approval are being caught out by rising interest rates after learning their borrowing capacity might have changed. Selected Interest Rates - H15.

Content last reviewed and updated on 2704. Industrial Production and Capacity Utilization - G17. Clearly higher interest rates are eroding borrowing capacity CoreLogics Tim Lawless told ABC News.

The other half is choosing the best type of mortgage. 27 Mortgage Opener. Mortgage Debt Outstanding.

Wealth to get and give feedback on how best to enhance the clients borrowing experience give competitive data on pricing. Survey of Consumer Finances SCF Survey of Household Economics and Decisionmaking. The couple both 29 built in Melbournes outer south-east last year.

How Do Rising Interest Rates Impact Your Borrowing Capacity. Mortgage and Foreclosure Resources. 30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US 2022-09-08.

Using a home equity loan you can access some of that money up to 80 of the propertys total. The eligible non-borrowing spouses age is factored into the loan to value calculation on the reverse mortgage loan because of the deferral option that they are eligible for. Subprime mortgages was estimated at 13 trillion as of March 2007 with over 75 million first-lien subprime mortgages outstanding.

The value of US. 3 The New York Fed regards the level of a firms regulatory capital as one indication of its operational capacity to perform the responsibilities of a primary dealer. SYSC 279 Material relating to several FCA certification functions.

Selected Interest Rates - H15. What makes a great mortgage broker. So to help you finding a great broker weve provided some helpful hints below.

SYSC 278 Definitions of the FCA certification functions. Federal Reserve Community Development Resources. By January 2008 the delinquency rate had risen.

Micro Data Reference Manual MDRM Micro and Macro Data Collections. Lake Mead is down to 27 of capacity exposing all sorts of things previously submerged. Whether any additional fees or charges may apply and whether the terms of the loan meet your needs and repayment capacityComparison rate based on loan amount of 150000 and a term of 25 years.

SYSC 275 Exclusions for emergency and temporary appointments. As a Mortgage Lending Closing Officer or equivalent experience working for an attorney in a residential loan closing capacity or working with another mortgage company in the loan closing area. That lenders charge you for the privilege of borrowing money that you can repay over.

Latest news expert advice and information on money. Pensions property and more. A Las Vegas police homicide lieutenant is on the case.

Calculate my borrowing power ME N Item - 4 Col c Refinancing. Prices nationally would need to drop by 28 per cent to take the market back to where it was. Check your mortgage contract to see whether you can change your repayments without incurring costs.

SYSC 277 Specification of functions. Including a corroding steel drum with a body inside complete with gunshot wound. Minutes of the Boards discount rate meetings on July 18 and July 27 2022.

They expected to have a couple of years of record-low interest rates to start paying down their mortgage after Reserve Bank. SYSC 27 Annex 1 Examples of how the temporary UK role rule in SYSC 2753R the 30-day rule. The 5 Cs of credit are important because lenders use them to set loan rates and terms.

If your home is worth 700000 and you owe 400000 on your mortgage then your equity is 300000. An eligible non-borrowing spouse can become ineligible over time if they move out of the property during the period that the reverse mortgage is in place. Approximately 16 of subprime loans with adjustable rate mortgages ARM were 90-days delinquent or in foreclosure proceedings as of October 2007 roughly triple the rate of 2005.

There are a number of reasons why refinancing could be a great idea - the biggest being financial. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float. SYSC 276 Other exclusions.

Mortgage brokers are professional loan negotiators. Learn your limits - suss out your borrowing capacity so you can start planning that purchase. Industrial Production and Capacity Utilization - G17.

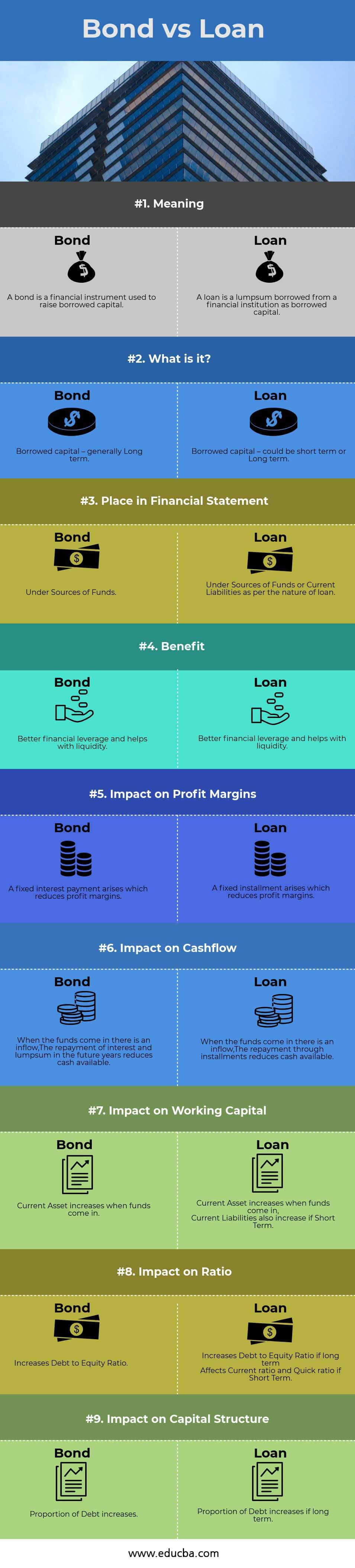

Bond Vs Loan Top 9 Differences To Learn With Infographics

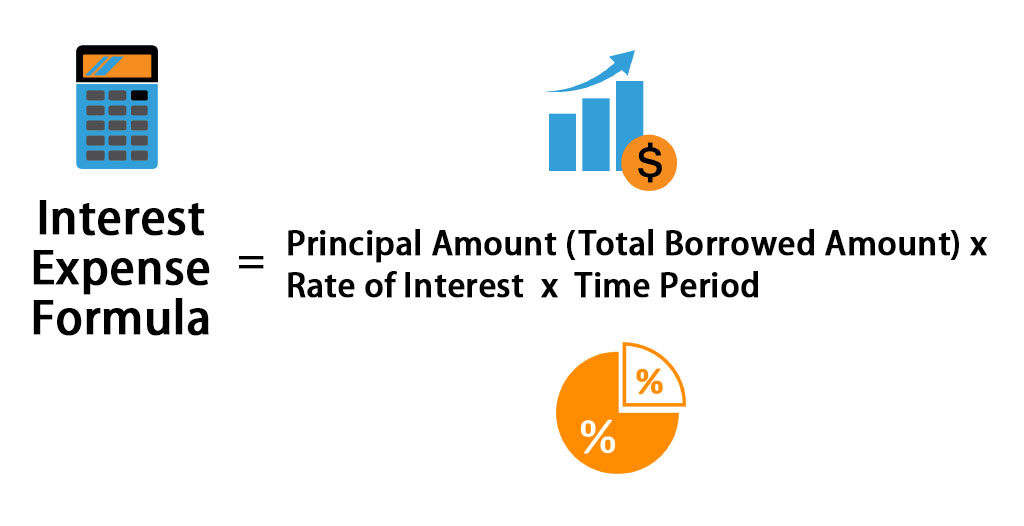

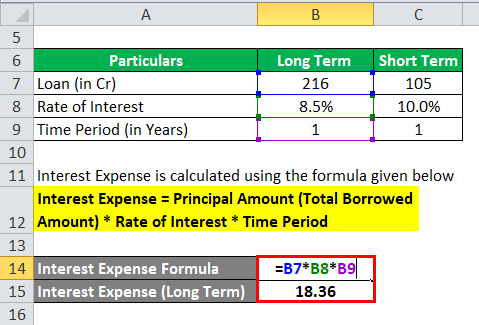

Interest Expense Formula Calculator Excel Template

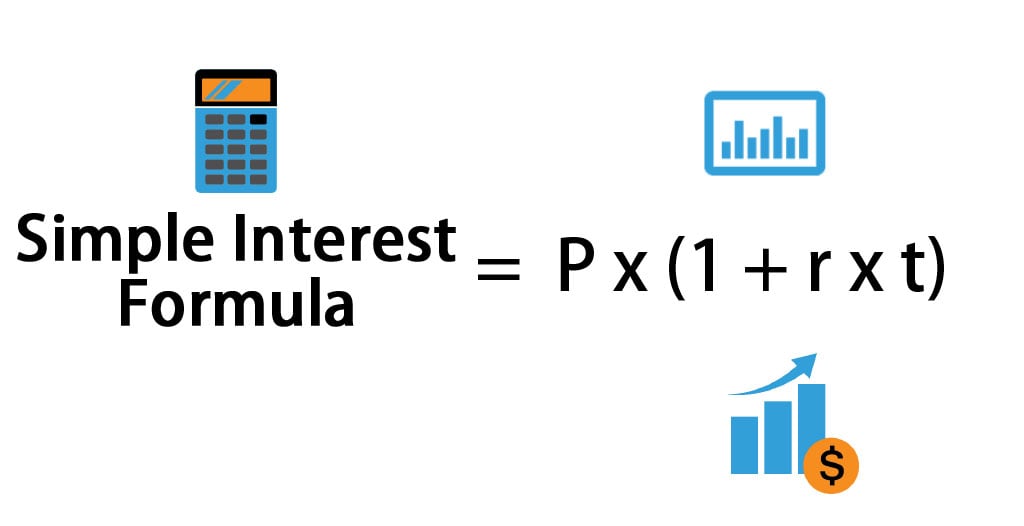

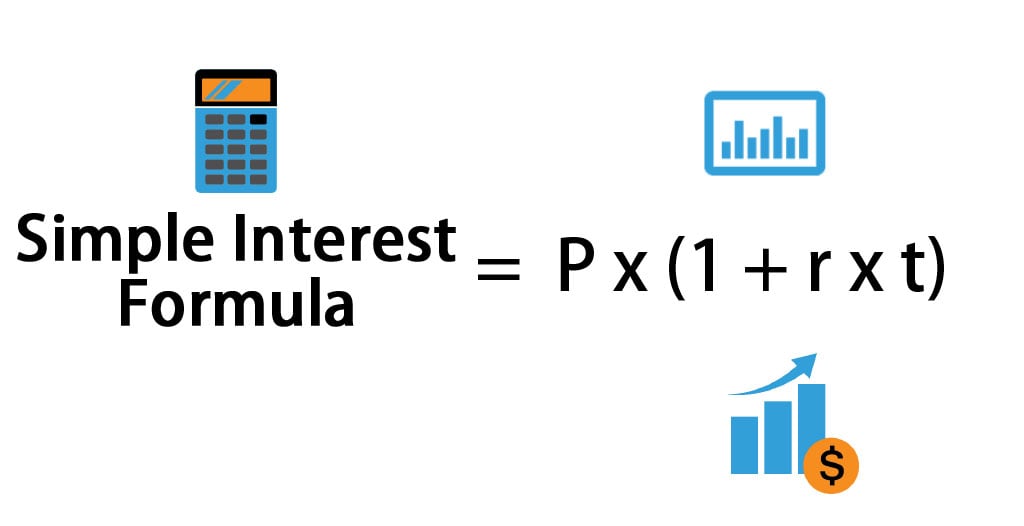

Simple Interest Formula Calculator Excel Template

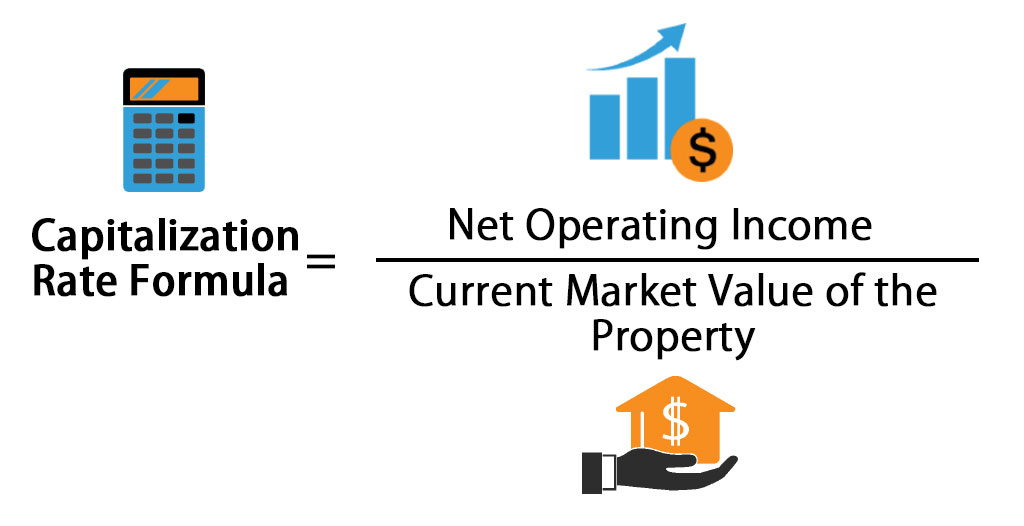

Capitalization Rate Formula Calculator Excel Template

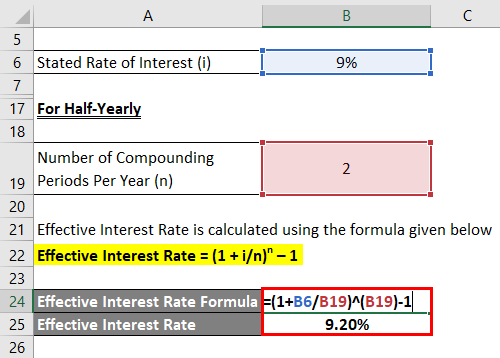

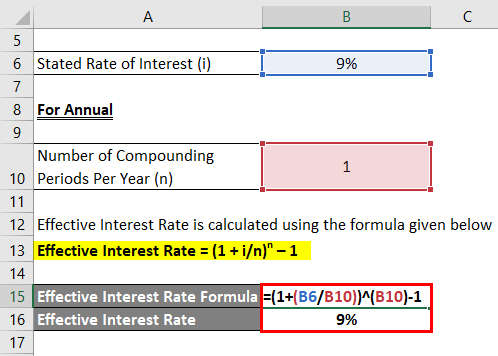

Effective Interest Rate Formula Calculator With Excel Template

Interest Expense Formula Calculator Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn

Effective Interest Rate Formula Calculator With Excel Template

27 Consumer Debt Statistics Depicting The Crisis Fortunly

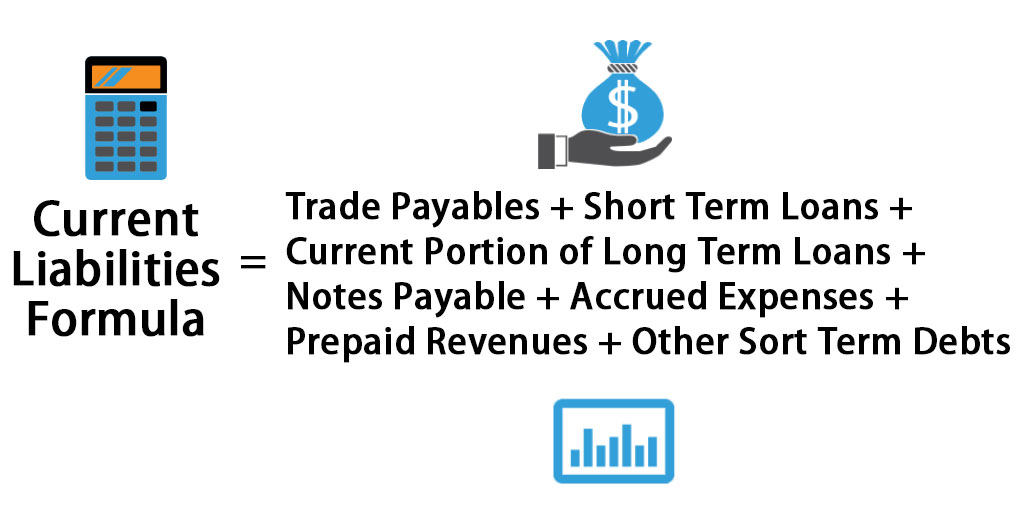

Current Liabilities Formula How To Calculate Current Liabilities

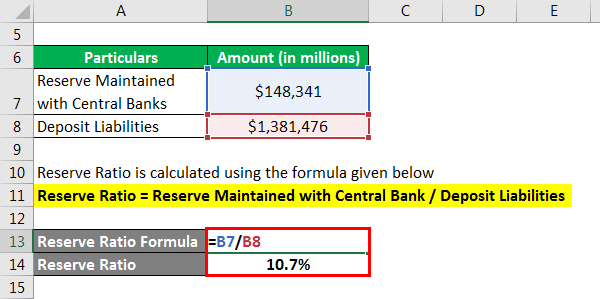

Reserve Ratio Formula Calculator Example With Excel Template

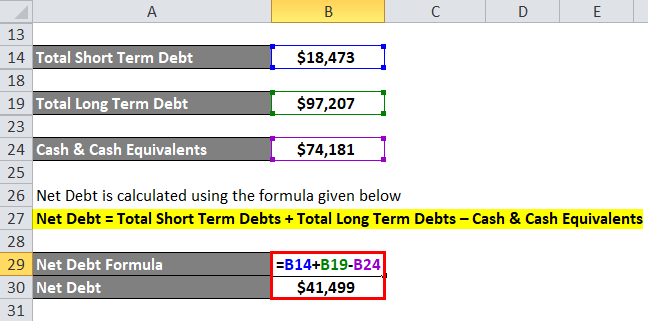

Net Debt Formula Calculator With Excel Template

Net Debt Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn